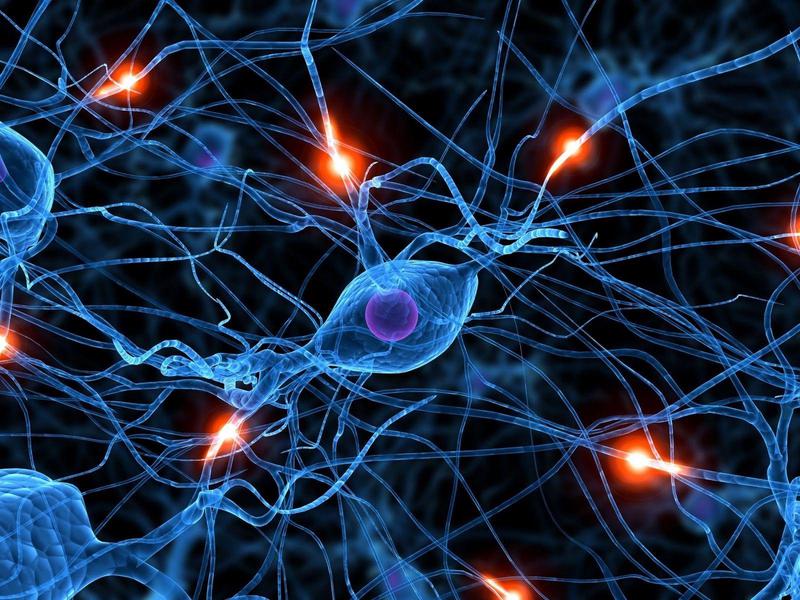

Quantum computers put the crypto industry at risk

“Quantum computing takes advantage of the strange ability of subatomic particles to exist in more than one state at any time. Due to the way the tiniest of particles behave, operations can be done much more quickly and use less energy than classical computers” — BEALL, A (2018)

That was the description given by Beall, A on its article titled “What are quantum computers and how do they work?”. The author states that the next generation of supercomputers will solve the most difficult problems, br

That was the description given by Beall, A on its article titled “What are quantum computers and how do they work?”. The author states that the next generation of supercomputers will solve the most difficult problems, br